There's a reason MoneyWeek is Britain's best-selling financial magazine. We exist to help you ground your portfolio so that it keeps your money safe during rough patches and growing in the good times. We don't just look at how to maximise your returns and limit your losses, we also like to look at how you can keep more of the money you've made.

Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor-in-chief...

Supply shortage of the week

Good week for:

Bad week for:

Diverging fortunes for big tech

Small caps start to struggle

Gold holds up in early turmoil

Viewpoint

The Bank turns hawkish

■ The shrinking pool of negative yields

MoneyWeek’s guide to this week’s share tips

A Singaporean view

IPO watch

City talk

Meta takes a tumble • The owner of Facebook, WhatsApp and Instagram is struggling with slower growth and problems winning over young users. Matthew Partridge reports

Riding to Peleton’s rescue

All change at Downing Street • While the PM shuffles the deck chairs, Britain steams into crisis. Emily Hohler reports

The jaw-jaw continues over Ukraine

Canada’s freedom convoy • Covid-19 protests are snarling up the country. Matthew Partridge reports

The slow process of re-opening borders

Betting on politics

News

The way we live now... living next door to Snoop Dogg in the metaverse

The long arm of Xi Jinping • Like most countries, China is dedicated to projecting soft power and building links with institutions abroad. Unlike most other countries, that is rattling Western governments. Simon Wilson reports

Lidl’s secret sauce • Piling it high and selling it cheap is not the easy money-making strategy it might seem. Buy up those who can do it well

Who’s getting what

Nice work if you can get it

Get ready for higher rates • Central banks are starting to raise interest rates. Which stockmarkets are best-placed to cope?

I wish I knew what duration was, but I’m too embarrassed to ask

Guru watch • Larry Fink, chairman and CEO, BlackRock

Best of the financial columnists

Money talks

Green lairds buy up Scotland

Who cares about plagiarism?

How to make a tough call

CEOs deserve their wedge

Profiting from market turbulence • Short and leveraged ETPs could be useful for making trading bets as tech stocks fall

Activist watch

Short positions... Yiu’s lucky escape

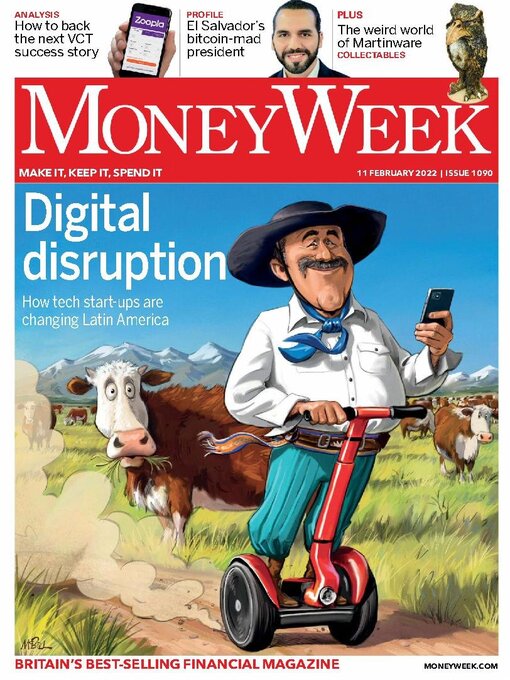

Latin America’s digital revolution • A region that was once an innovation desert is changing rapidly. Billions of dollars of venture capital funding and the impact of the pandemic are creating new tech giants. James McKeigue reports

The new wave of tech leaders

Cut your tax bill with VCTs • Demand for venture capital trusts is on track to set a new record this year. David Prosser reports

Top VCT picks for 2022

Protect your mortgage • Rising interest rates pose a threat to your mortgage, but it’s not all bad news. Here are some ways to secure a better rate

Pocket money... the true value of 50p coins

The crypto challenge • There are several things to consider when offering this new way to pay

Be ready for the NI hike

Educating staff on cybercrime

Shorting Trump •...